On July 21, LexisNexis ® Risk Solutions, a leading provider of data, analytics and technologies for the insurance industry, presented the LexisNexis ® Risk Classifier with medical data, the first solution that combines up to six sources of behavioral and medical data and provides life insurers with a predictive mortality model that allows them to more accurately assess risk and help competitive pricing policy. This innovative solution was developed to improve the life insurance experience for insurers and consumers, giving life insurers more predictive, valuable data for an in-depth picture of risk so that more consumers can get access to the life insurance they need to protect their loved ones.

LexisNexis Risk Classifier with Medical Data aggregates long-standing and actuarially proven data sources including public records, credit attributes and driving behavior data as well as prescription history, medical diagnosis and clinical lab attributes. It is available through a strategic relationship with ExamOne®, a Quest Diagnostics company, which obtains medical data for this purpose with an insured applicant’s authorization, to form a next-generation mortality model that life insurers can integrate into their existing workflow for accelerated underwriting.

“Life insurance carriers are continually looking for ways to drive better risk differentiation and improve the consumer experience to build a competitive advantage,” said Debra Gangelhoff, vice president and general manager of Life Insurance at LexisNexis Risk Solutions. “The combination of behavioral and medical data integrated in one model through LexisNexis Risk Classifier with Medical Data helps life insurers reveal additional unknown risks and improve their mortality scoring for confidence in their underwriting program. It also helps lower underwriting costs and can help put a higher percentage of consumers through an accelerated underwriting path.”

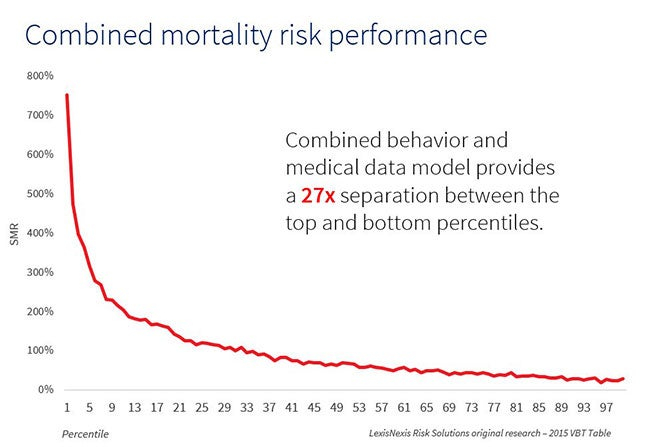

According to the data scientists at LexisNexis Risk Solutions, the next-generation combined model provides more mortality separation across risk classifications to determine a more accurate mortality score. This will help enable carriers to deliver consumers a faster and easier life insurance underwriting process. Ultimately, this can assist in getting more life insurance policies in the hands of more consumers.

“We found that when it comes to modeling mortality risk, combining behavior and medical data into a single model provides a 13x separation between the top and bottom deciles, which is 2.5x greater than prescription data alone, and it provides a 27x separation between the top and bottom percentiles,” said Patrick Sugent, vice president of Analytics at LexisNexis Risk Solutions.

Unlike traditional life insurance underwriting, which typically requires a paramedical exam, and often has lengthy application and underwriting processes, LexisNexis Risk Classifier with Medical Data helps life insurers get more information upfront, which may allow them to avoid the paramedical process altogether and accelerate their underwriting. As a result, consumers applying for life insurance appreciate the faster, more streamlined and less invasive life insurance underwriting process.

“The current economic climate and accelerated underwriting options provide life insurers with opportunities to reach new, untapped markets that have not traditionally bought life insurance before,” said Gangelhoff. “We are excited about the opportunity to help them continue maximizing data and advanced analytics to grow business and get life insurance in the hands of more families.”

For more information, please visit LexisNexis Risk Classifier with Medical Data.

4

4