Providing more aid to struggling governments has become one of the biggest issues tangling up the debate over another pandemic rescue package.

The U.S. economy struggled to shake off the last recession, with historically slow growth and a labor market that took more than six years to recover its earlier employment levels. A big part of the reason: state and local governments, which cut spending and fired workers amid widespread budget shortfalls.

The same dynamic poses one of the biggest threats to America’s recovery from the pandemic downturn. State governments are again experiencing extreme budget problems as they pay out increasing sums to cover unemployment and health costs caused by the coronavirus crisis while revenues from sales taxes and corporate and personal income tax payments plummet. States could face a gap of at least $555 billion through the 2022 fiscal year, according to one estimate.

Economists warn that the long-term risk coming from struggling states could prove even more damaging this time than the recession of 2007-9 unless Congress steps in. Yet providing more aid to state and local governments has become one of the biggest political battles in the fight over another pandemic rescue package.

The Senate formally adjourned on Thursday until early September, all but ending any chance that an agreement could be reached soon. House members had already left Washington.

President Trump and top Republicans, including Senator Mitch McConnell of Kentucky, the majority leader, warn that providing more money to states could simply bail out fiscally irresponsible governments that did not manage their budgets and their public pension plans prudently in good times. Treasury Secretary Steven Mnuchin said Wednesday in a television interview that most states had not exhausted the $150 billion that was allocated in the relief bill passed in March, though analysts say much of that has already been earmarked for certain projects.

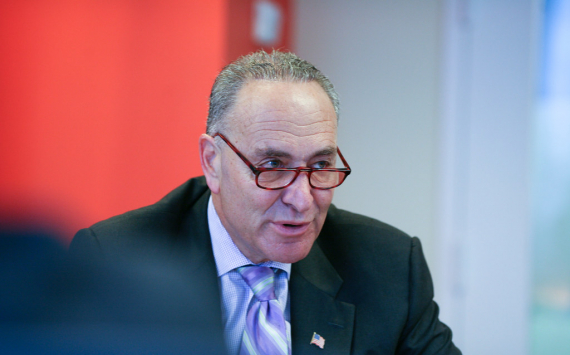

Democrats insist that states need more money and have proposed as much as $1 trillion, saying it would support needed services and help the economy recover more quickly.

While many governments entered the downturn with solid tax revenues and billions of dollars in their rainy-day funds, those coffers are quickly dwindling. State revenues “could fall as much as or more than they did in the worst year of the Great Recession and remain depressed in following years,” according to the Center on Budget and Policy Priorities, a progressive think tank.

Nearly all states are required to balance their budgets, meaning officials will need to plug shortfalls by tapping rainy-day funds, raising taxes or cutting costs, including jobs.

That worries economists and Federal Reserve officials. Jerome H. Powell, the Fed chair, regularly warns that state job cuts could weigh on the economy’s ability to recover, and his colleagues warn of public-sector budget pain as one of the primary vulnerabilities ahead.

“It will hold back the economic recovery if they continue to lay people off and if they continue to cut essential services,” Mr. Powell said during congressional testimony in June. “In fact, that’s kind of what happened post the global financial crisis.”

Charles Evans, president of the Federal Reserve Bank of Chicago, echoed that sentiment in a CBS interview on Sunday, saying, “As you look at the economic outlook, there are some negative scenarios, and the ones that are most pessimistic involve not supporting state and local governments.” Absent that help, Mr. Evans said, “there will be employment reductions.”

While it is unclear how persistent job cuts will be — some jobs may still come back as economies reopen — state and local job losses this year have already dwarfed those in and after the entire Great Recession. Back then, state and local governments cut about 750,000 jobs over nearly five years.

Just since February, about 1.2 million local government jobs have been lost. Moody’s Analytics researchers estimate that 2.8 million more could be on the chopping block without more federal help. If that happens, state and local job cuts stand to shave about 2.6 percent from overall pre-crisis employment levels.

While some employers have begun rehiring, nearly 13 million people remain out of work across sectors, and the unemployment rate stood at 10.2 percent in July.

Jobless claims, which are calculated differently, remain elevated. The Labor Department said on Thursday that weekly initial jobless claims fell below one million for the first time since March, with 963,000 new workers filing for unemployment insurance. That is still higher than the peak level in the 2007-9 recession, and economists warn that the recovery is slowing as the virus lingers and businesses struggle to reopen fully.

With unemployment high and many businesses expected to close, states are bracing for more safety net costs on top of the public health expenses they are already incurring. They spend a large chunk of their budgets on Medicaid payments and services for low-income residents.

Yet the Trump administration and many Republican lawmakers have largely brushed off state financial woes, insisting that governors and other local leaders foot part of the pandemic aid bill and refusing to “bail out” Democratic-led states struggling with huge shortfalls in their public pension plans.

Over the weekend, Mr. Trump suggested tapping state coffers as part of his plan to extend pumped-up unemployment insurance benefits, which had been going to millions of workers until the program expired at the end of July.

Governors, including some Republicans, expressed concern about the administration’s attempt to have states shoulder more financial responsibility. Mr. Trump’s proposal that states contribute an extra $100 in weekly unemployment benefits in order to get a $300 supplement from the federal government received a chilly reception from many state officials.

“They just don’t have the money to kick that in,” said Dan White, director of government consulting and fiscal policy research with Moody’s Analytics.

The administration soon shifted the policy to fit that reality. Officials in the office of Gov. Mike DeWine of Ohio, a Republican, said they were told late Sunday by the Labor Department of a new option allowing unemployed workers to claim the additional $300 per week without the state’s kicking in an extra $100.

By midweek, White House aides were making clear in interviews that the state payment was largely optional.

“We are no longer insisting on a cost-sharing deal,” Larry Kudlow, Mr. Trump’s economic adviser, told Fox Business.

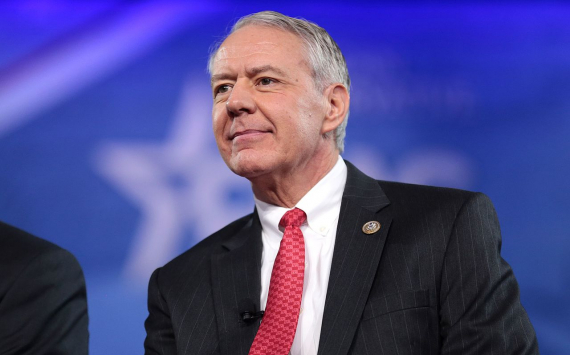

Even so, Mr. Kudlow voiced wariness of unfettered additional assistance to states. And while Mr. Mnuchin said the White House was willing to provide an additional $150 billion to states for coronavirus-related costs, that is far less than other policymakers have suggested may be needed. A bipartisan group of lawmakers, including Senator Bill Cassidy of Louisiana, a Republican, are pushing a bill that would give states $500 billion.

“Yes, it is a concern that we’re spending the money now, but the alternative looks far worse,” Mr. Cassidy said this week in an interview, referring to many Republicans’ reluctance to add to the nearly $3 trillion already spent.

Analysts say the actual need probably falls somewhere between the various proposals. Moody’s Analytics, for instance, estimates that states and localities will face a $500 billion budget hole through 2022 if the worst of the pandemic is already past and $750 billion if the United States faces a second pandemic wave this fall.

Mr. Mnuchin has said Democrats want federal money to help support ailing pension funds and to fill budget shortfalls that states were facing before the pandemic — an assertion that Democrats push back on and an outcome that analysts say could be prevented by including restrictions in the legislation.

“What did they say? ‘Let them go bankrupt,’” Speaker Nancy Pelosi of California said of Republican negotiators at her weekly news conference on Thursday. “Economists tell us that our economy depends on the fiscal soundness of state and local government.”

The economic risks are not confined to blue states. Idaho, West Virginia and Alaska, all Republican-dominated states, also face acute budget shortfalls as a percentage of output, based on estimates from Mr. White and his colleagues at Moody’s Analytics.

Hard-hit governments “will start pulling the trigger on cutting services and raising taxes” in the coming years if they do not get help, said Ernie Tedeschi, policy economist for Evercore ISI, a research firm. Such cuts “don’t necessarily plunge you back into recession, but they can slow down the economy.”

Already, many states are dipping into rainy-day funds or using other temporary measures to meet their requirements for balanced budgets, and spending cuts are already underway or proposed in many places. In New York, for instance, lawmakers in April gave Gov. Andrew M. Cuomo a one-year window to cut spending unilaterally as merited as the state faces down a huge shortfall.

The pain extends to local governments. More than 700 cities have scrapped plans to work on roads, buy equipment and upgrade critical infrastructure since the pandemic began, based on a survey by the National League of Cities.

States and localities have already slashed about 6 percent of their combined work forces since the downturn began. And while their hiring showed a rebound last month, that was only because of a quirk in how the data are adjusted for seasonal fluctuations.

Brian Sigritz, director of state fiscal studies for the National Association of State Budget Officers, said it would probably take years for state budgets to restore their footing.

“It will be a drag on G.D.P. growth at a time when the nation’s economy is attempting to recover,” Mr. Sigritz said.

Source: https://www.nytimes.com/2020/08/14/business/economy/state-local-budget-pain.html